directors fees tax treatment malaysia

Understanding Input Tax Recovery Rules Live Webinar 0900 AM - 0500 PM. A The inventory valuation rules acceptable for tax purposes by countries vary widely.

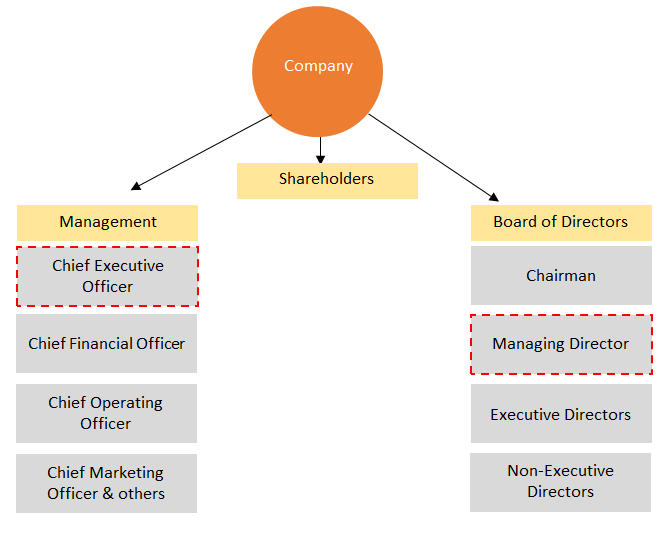

Chief Executive Officer Vs Managing Director Top 5 Differences To Learn

For the tax year 2021 onwards the corporate income tax CIT rate of legal entities with the exemption of credit institutions has been reduced to 22.

. Data and research on tax including income tax consumption tax dispute resolution tax avoidance BEPS tax havens fiscal federalism tax administration tax treaties and transfer pricing This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. Schedule agreement between the republic of fiji and the government of malaysia for the avoidance of double taxation and the prevention of fiscal. B Corporate membership - Membership subscription paid by employer.

Our fees to assist you. Most states ask for only basic information about the corporation but some require more information than others. Furthermore credit institutions are taxed at a rate of 29 only if and for those tax years that they are subject to the specific provisions of Art.

Some general accounting policies that have a significant impact on the tax base relate to inventory valuation depreciation policies lease accounting and treatment of foreign exchange gains and losses. Corporate Law - Real Estate Regulation and Development Act 2016 is a transformation legislation for the Real Estate Industry. In addition to the fees and charges set forth above you are responsible for all charges and fees associated with.

At any time during the basis year for a year of assessment at least one meeting of the board of directors is held in Malaysia concerning the management and control of the company even though all other meetings are held outside Malaysia then the company is. It is hard to accept the various provisions of the Act rules having practiced and followed the business without regulations over 75 years. This full version contains the full text of the Model Tax.

Article 16 directors fees article 17 entertainers ss 13 cl 1. Term membership - is taxed on the amount of payment made under paragraph 131a of the ITA 1967. At the national level taxes are imposed and collected pursuant to the National Internal Revenue Code the Tariff and Customs Code and several special laws.

Access the one-stop calendar of tax events and seminars anytime and anywhere. The provisions of Articles 15 Independent Personal Services 16 Dependent Personal Services 18 Directors Fees 19 Artistes and Athlete s and 20 Pensions Annuities Alimony and Child Support shall apply to remuneration and pensions in respect of services rendered in connection with a business carried on by a Contracting State or. Tax treatment on the benefit received on the employee as follows.

All states require an in-state registered agentThe corporations existence legally begins when the state files the articles. Where no specific tax treatment is prescribed the taxable value will be the higher of the cost to the employer or the fair market value of providing the benefit. And b in situations of abuse ie.

TAX FORM -- It is usual to design special forms for taxpayers to declare their taxable income sales etc. The directors will each have to make a declaration stating that the Company has either not commenced business since incorporation or have ceased business have no assets and liabilities as well as do not have any dues to the authorities. The Son-Rise Program Online Contains 9 Months of Parent Training A Social Development Curriculum and Everything You Will Need To Start An Effective Home Treatment Program.

A nonprofit corporation or LLC protects directors officers and members if it has any members against being held personally responsible for their companys debts and liabilities. Division 2 procedural rules for income tax social responsibility tax and presumptive income tax ss 104125a. Malaysia Service Tax 2018.

27A of the Income Tax Code ITC regarding. Income Tax Treatment on Foreign-Sourced Income Live Webinar 0900 AM - 0500 PM. SST Treatment in Designated Area and Special Area.

Because that limited liability protection is provided for by statute an informal organization does not have that. TAX FORECLOSURE -- The process of enforcing a lien against property for non-payment of delinquent property taxes. Tax Updates in Malaysia Analysis of Budget 2023 Other Updates.

Forms are designed to facilitate the task of the tax authorities in assessing and collecting tax and will. Courageous and radical provisions are included in the Act. SST Treatment in Designated Area and Special Area.

In a move to keep Malaysia competitive the country has gradually reduced its corporate tax rates from 27 percent in year of assessment YA 2007 to 26 percent in YA 2008 25 percent for YAs 20092015 and 24 percent for YA 2016 and later years. Generally speaking a housing benefit is taxed at the higher of 15 of gross remuneration excluding housing and the rent paid by the employer. From 2024 onwards the Netherlands will apply a conditional withholding tax at a rate equal to highest corporate income tax rate 258 per cent as of 2022 a on dividend payments to shareholders established in low-tax jurisdictions.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. Where artificial arrangements are employed to avoid the imposition of Dutch. There are four main types of national internal revenue taxes.

Income indirect value-added and percentage taxes excise and documentary stamp taxes all of which are administered by the Bureau of Internal Revenue. Best Tax Software For The Self-Employed Of September 2022 By Kemberley Washington Forbes Advisor Staff 6 Tips To Get A Head Start On Your 2021 Taxes. Malaysia Service Tax 2018.

Start Your Own In-Home Autism Treatment Program. Monthlyannual membership subscription fees for club membership - taxed under paragraph 131a of the ITA 1967. Articles of incorporation the articles is the document filed with a state to create a corporation.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Disheartened Director Of Bureau Of Prisons Calls On Staff To Out Corruption

What Is Section 164 2 Disqualification Of Directors

Pdf The Moderating Effect Of The Board Of Directors On Firm Value And Tax Planning Evidence From European Listed Firms

Taking Dividends Vs Salary What S Better Starling Bank

Tax Planning For The Director Company Director S Salary Structure

What Is The Deemed Interest Income Taxable On A Director Loan From A Company

Do You Know How To Withhold Tax From Directors Fees Tax Alert August 2017 Deloitte New Zealand

How To Inform Mca Roc In Case Of The Death Of The Director

Differences Between Enterprise Sdn Bhd For Business Owners Foundingbird

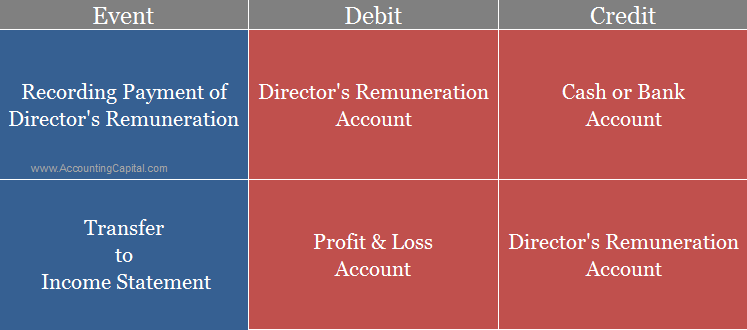

Journal Entry For Director S Remuneration Accountingcapital

Malaysia Taxation Of Professional Services Kpmg United States

Director S Duties To Avoid And Disclose Conflicts Of Interest Free Advice

Required Documents For Incorporate Business In Singapore Incorporated Business Singapore Business

Malaysia Taxation Of Professional Services Kpmg United States

Journal Entry For Director S Remuneration Accountingcapital

What Happens To A Director During Liquidation Aabrs

Can Directors Be Held Liable For Business Debts In A Limited Company

No comments for "directors fees tax treatment malaysia"

Post a Comment